During the on-going crisis of the Covid-19, Reserve Bank of India issued an order of cancelling the license on 28th April 2020, of 105-year-old Maharashtra based Co-Operative bank. The order stated that from 30th April 2020, the bank will not function. The bank is CKP Co-Operative bank which has headquarters in Matunga, Mumbai. This bank had 9 branches spread across Maharashtra’s two districts Mumbai and Thane.

The bank had 1,32,170 depositors and as of November, 2019 it had ₹485.56 crore as total deposits and loan register read as ₹161.17 crore. Out of total depositors 99.2% which is roughly 1,31,113 depositors will get their 100% money back from Deposit Insurance and Credit Guarantee Corporation.

Deposit Insurance and Credit Guarantee Corporation (DICGC)

DICGC is a fully owned subsidiary RBI which ensures the safety of depositors and enables trust in the banking sector of the country. It acts as a safeguard for all the account holders of all the commercial banks which fall under the jurisdiction of RBI. Before the budget of 2020-21 the limit of amount the account holder could get was ₹1,00,000 and now the limit has increased to ₹5,00,000.

As of August 2019, the bank possession of properties worth ₹58,08,09,947 and willful defaulters worth ₹20,989.27 Lakhs as of March 31st, 2018. 97% of the total loans sanctioned by the bank had unfortunately turned into NPAs. This was because the majority of the loans were granted to small and medium-size Mumbai based real estate developers. According to sources of Moneycontrol.com there are 10 developers which account to majority amount of the NPAs.

RBI defines a willful default would occur if:

· The person who is incapacity to pay back the loan but doesn’t pay

· Diverts the funds, for instance, if the loan is taken for expanding the business but the amount sanctioned is spent on personal expenses of the loan applicant

In India the number of wilful defaulters is increasing year by year. According to an RTI filed by TheWire in May 2019 the RBI released the list of top 100 defaulters. The total default amount of just these top 100 was recorded as ₹90,544 crore. The list has people like Kingfisher Airlines Limited, Gitanjali gems, Ruchi Soya Industries Limited, Shreem Corporation limited and many more. The list is spread across various sectors from jewellery to pharma to airlines to food everywhere. The highest amount in the list is valued ₹5,492 crore which is of Gitanjali Gems owned by Mehul Choksi and the lowest is worth ₹283 crore.

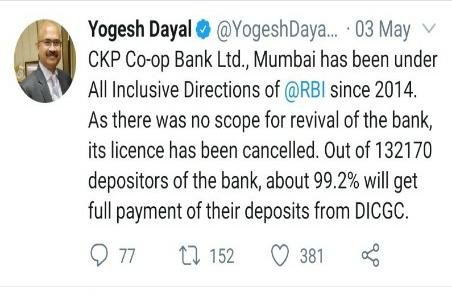

Yogesh Dayal

The Chief Manager of RBI, Communication Department, Yogesh Dayal, on 3rd May, 2020 assured 99.2% of the total depositors of CKP Bank that they will get their whole deposit back. He also shared a whole document stating the reasons as to why RBI had to take such a step against CKP bank. Reasons mentioned by Yogesh Dayal on behalf of RBI are as follows:

- The financial position of the bank is highly adverse and unsustainable. There is no concrete revival plan or proposal for a merger with another bank. Credible commitment towards revival from the management is not visible.

- The bank is not satisfying the requirement of minimum capital and reserves as prescribed in Section 11 (1) read with Section 56 of the Act and capital adequacy and earning prospects as stipulated in Section 22(3)(d) of the Act and also stipulated minimum regulatory capital requirement of 9%.

- The bank is not in a position to pay its present and future depositors, thereby not complying with Section 22(3) (a) read with Section 56 of the Act.

- The affairs of the bank were and are being conducted in a manner detrimental to the public interest and interest of the depositors and that the general character of the management of the bank is prejudicial to the interest of depositors as also public interest. Thus, the bank has not been complying with provisions of Section 22 (3)(b) and (c) of the Act.

- The bank’s efforts for revival have been far from adequate though the bank has been given ample time and opportunity and dispensations. No merger proposal has been received in respect of the bank. Thus, in all likelihood, public interest would be adversely affected if the bank were allowed to carry on its business any further.

- No useful purpose would be served by allowing the bank to continue as envisaged in Section 22(3)(e) of the Act. Rather, Public interest would be adversely affected if the bank is allowed to carry on its banking business any further.

My Take

It is high time for the government and the Reserve Bank of India to frame and act faster towards implementing more laws which are inevitable. This is the 3rd Bank which has failed due to defaulters in past 9 months. If both the bodies work in full synergy, this will help in nation building because the banking sector will become strong. If the banking sector is strong it means that more loans will be available at affordable prices resulting in more innovations, employment, tax revenue etc. Only if the total amount defaulted by the 1st and the 100th company comes back into the economy the loan prices will go down and if at all the whole amount which is ₹90,544 crore comes back into the economy the loan prices will fall drastically and we will again get the title of “Sone Ki Chidiya”

Note: This article was written by me for The Economic Transcript, Mithibai Economic Forum, Mithibai College.