Government collects taxes to pay for the goods and services it provides including schools, roads, law enforcement, libraries, parks and military protection etc. The taxes are imposed with the intention of reducing the income inequality gap.

The Indian government generates revenue via various taxes which fall under the main bracket of Indirect and Direct taxes. According to a study in India, the collection from indirect taxes is more as compared to collection from direct taxes.

| Total Revenue | Total Expenditure | Total Deficit |

| ₹10,54,101.22 cr | ₹19,78,060 cr | ₹9,23,958.78 cr |

The government of India paid ₹2,50,000/per month for each MP in 2015 according to The Hindu. Distribution of ₹2,50,000 is as follows:

- ₹50,000 as salary

- ₹45,000 as constituency allowance

- ₹15,000 as office expenses

- ₹30,000 as secretarial assistance

- 34 flight trips + unlimited road and rail trips all year round

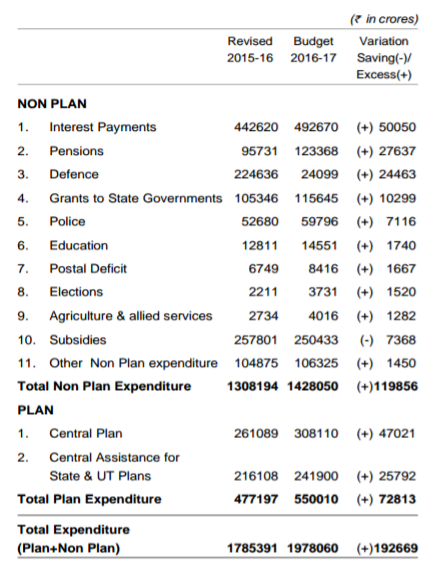

India being a developing country needs to change the salary structure of the MPs and channelize the amount in a more productive way. Actual allocation of funds for the year 2016-17.

The need to change the structure of expenditure

- India being an agriculture country needs proper allocation of funds to that sector because around 70% of the total population of the country depends on agriculture for their living.

- To solve the unemployment problem Indian government needs, allocate funds for promoting business houses which can solve the problem of unemployment.

- India being a country where there are n number of loopholes for each law, there should be an allocation of funds in that field.

- Having neighbours like Pakistan and China, there should be more expenditure on defence.

- To develop human capital, there should be a major contribution to this field for better quality of professionals.

- To facilitate easy movement of labour, goods etc India needs to invest in infrastructure

My Take

The ideal plan according to me would be as follows:

Let’s assume that India has ₹10,00,00,000. Division of funds would be: –

- ₹3,00,00,000 Agriculture

- ₹25,00,000 Law and Order

- ₹2,00,00,000 Promoting business firms

- ₹2,00,00,000 Defense

- ₹1,00,00,000 Education

- ₹1,00,00,000 Infrastructure

- ₹70,00,000 MPs

According to me promoting agriculture, business firms, education and infrastructure is a long-term investment which will yield high returns. Expenditure on defence and law and order will make the country safe.

This article was written by me for The Economic Transcript, Mithibai Economic Forum, Mithibai College.